Zakat Questions & Answers

All about zakat we have tried to cover below and we hope it will help you to calculate and pay your zakat. Feel free to browse and find answers to your questions.

What is Zakat?

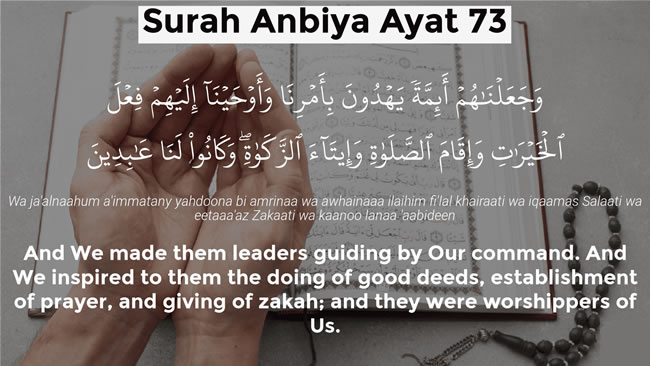

Zakat, which means “alms,” is more deeply understood as “purification” and “growth,” symbolizing the encouragement of equality and prosperity within the community through the sharing of one’s wealth. It is a religious obligation for all sane, adult Muslims whose annual wealth meets or exceeds the nisab threshold. As one of the Five Pillars of Islam, Zakat requires giving a fixed percentage of wealth each year to those in need, fulfilling the will of Allah (SWT) and completing a core aspect of Islamic faith. By giving Zakat, you help foster positive change across many countries and are blessed for contributing to the well-being of others.

How often is Zakat paid?

Zakat is an annual obligation in Islam and becomes mandatory when a person’s wealth exceeds a certain threshold, known as the nisab. If their wealth falls below this value, they are not required to pay Zakat for that lunar year. However, if it meets or exceeds the nisab, they must pay 2.5% of the total wealth above this threshold during that lunar year.

(Note: The Islamic lunar year is approximately 355 days.)

How do I calculate my Zakat?

You can easily calculate your Zakat using our online calculator. Alternatively, you can determine it manually with this formula:

Total wealth = Personal and business assets – Short-term liabilities

If your total wealth exceeds the nisab, you are eligible to pay Zakat. Your wealth calculation should include:

- Cash (savings, at home, or in bank accounts)

- Money set aside for property, weddings, or Hajj

- The total value of owned gold and silver

- The market value of any shares you own

- The value of business stock, if applicable

- Rental income from any properties

- Money owed to you that you expect to be repaid

Certain essential items, like your home, primary vehicle, and personal belongings, are exempt from Zakat, but Zakat is required on additional vehicles or properties. Liabilities such as debts, bills, and loans should be subtracted from your total wealth before calculating Zakat.

Who is eligible to pay Zakat?

According to Zakat rules, those required to pay include:

- Muslims of sound mind

- Free individuals (not enslaved)

- Adults who have reached puberty

- Those with wealth exceeding the nisab threshold

- Those with a positive cash or goods flow

In summary, Zakat is obligatory for adult Muslims who have wealth above the nisab and can comfortably meet their daily needs and those of their family.

Who is eligible to receive Zakat?

Zakat must be distributed to eight specific categories of people as outlined in the Qur’an:

- The poor (Fakir)

- The needy (Miskin)

- New converts to Islam (Muallaf)

- Those responsible for collecting Zakat (Amil)

- Slaves seeking freedom (Riqab)

- Stranded travelers (Ibnus Sabil)

- Those in debt (Gharmin)

- Those striving for the cause of Allah but away from home (Fisabillillah)

What is Nisab?

Nisab is the threshold amount that determines whether a Muslim is obligated to pay Zakat. The nisab value is calculated based on the current market value of 87.48 grams of gold or 612.36 grams of silver. When calculating Zakat, the value of these precious metals on the date of calculation is used to assess your total wealth over a full Islamic lunar year.

Another term, “Hawl,” refers to the Islamic lunar year. Zakat must be paid once every Hawl, provided your wealth exceeds the nisab value throughout the year. If your wealth fluctuates, your Zakat must be adjusted accordingly. If it drops below the nisab, you are no longer obligated to pay Zakat for that period.

How do I calculate my Zakat?

Your total wealth, excluding essential living items, is used to calculate Zakat. Items like your home, primary vehicle, and basic personal belongings are exempt, but additional properties or vehicles are subject to Zakat.

You should also deduct the following liabilities:

- Personal items (e.g., clothing, appliances)

- Debts, including mortgages, loans, and credit card balances

- Monthly bills, rent, or mortgage payments due when Zakat is calculated

- Short-term business loans or overdrafts, if relevant

- Business expenses like salaries, utilities, or rent

When calculating Zakat, include:

- Cash (savings, home, or in banks)

- Funds saved for property, weddings, or Hajj

- The value of gold, silver, or shares

- The value of business stock

- Rental income

- Money owed to you

Once you’ve added all relevant assets and subtracted liabilities, use this formula:

Total wealth = Personal and business assets – Short-term liabilities

If your wealth is above the nisab, you must pay Zakat.

When should Zakat be paid?

The due date for Zakat begins on the date when your wealth first equals or exceeds the nisab. After that, Zakat should be paid once every lunar year on that same date. If you cannot recall the exact date, you should estimate or select a specific Islamic date for future payments. While it is not mandatory to pay Zakat during Ramadan, many Muslims choose this time for greater spiritual rewards.

Where Should Zakat Be Distributed?

It is recommended to distribute Zakat within your local community whenever possible. This follows the guidance given by the Prophet Muhammad (PBUH) when he sent his companion, Mu’adh, to Yemen to teach Islam:

“O Mu’adh! Inform them that Allah (SWT) has made Zakat obligatory for them. It is to be taken from their rich and given to their poor.” [Bukhari]

However, it is also important to support those in need globally. Striking a balance between local, national, and international distribution is crucial. While supporting those in need in other parts of the world is essential, we must not overlook the increasing number of Zakat-eligible individuals in places like the UK. These people are equally entitled to the support of Zakat payers in their own country.

When Must Zakat Be Distributed?

Zakat becomes due when your wealth first reaches or exceeds the nisab threshold. From that point, you must calculate and pay Zakat after one full lunar year. This date will serve as your annual Zakat due date. If you can’t remember the exact date, make a reasonable estimate, or choose a specific Islamic date to follow consistently. While Zakat can be paid at any time of the year, many prefer to give it during Ramadan for increased spiritual reward.

What Happens if I Miss a Payment?

If Zakat has not been paid in previous years, it is important to calculate the missed amounts as accurately as possible and pay the outstanding balance immediately.

Can I Gift Aid My Zakat Payment?

Yes, Gift Aid can be applied to Zakat payments, allowing UK taxpayers to increase the value of their donations by 25%. Registered charities can claim this tax concession, making it a valuable addition to your contribution.

Can Zakat Be Paid in Advance?

Zakat can be paid in advance or spread throughout the year, as long as the full amount is paid by the due date.

Can I Spread Payments Over the Year?

Yes, Zakat can be paid in smaller instalments throughout the year. You can set up monthly payments, such as a direct debit, to make it easier. Some charities, like Al Mustafa Welfare Trust, offer Zakat-eligible campaigns and sponsorships, allowing you to contribute regularly and maximize the impact of your generosity.

What Wealth Does Zakat Include?

Zakat applies to certain assets, including cash, shares, pensions, gold, silver, business goods, crops, and livestock. However, personal items like your home, furniture, cars, food, and clothing are exempt. Zakat is still due on investment properties or non-essential assets.

What Are Tola, Bhori, and Yori?

Tola, also known as bhori or yori, is a traditional unit of weight used in the Indian subcontinent. One tola equals approximately 11.66 grams. Therefore, 87.48 grams of gold (the nisab threshold for gold) equals 7.5 tola.